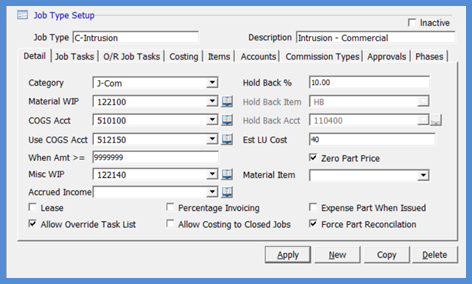

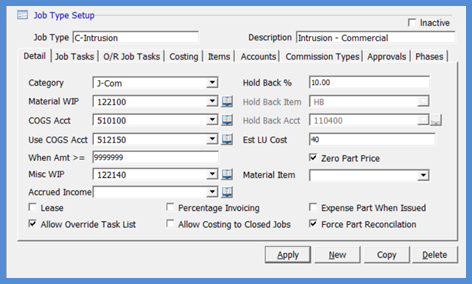

SedonaSetup Job Management Setup Tables/Options Job Type

Job Type Detail (continued)

Hold Back % - If the Job Type dictates your customer will hold back a certain percentage of the amount invoiced until the job is completed, you will enter the percentage amount in this field. If an amount is entered in this field you will also need to make entries into the next two fields; Hold Back Item and Hold Back Acct.

If a Hold Back Item and Hold Back Account is assigned to a Job Type, but the Hold Back % is set to zero, the Job Type may be used for hold back situations or non-hold back situations. However, if you want to use the Job Type for a Hold Back situation, the hold back % will not automatically be calculated on the customer Invoice; hold back amounts would need to be manually entered by the User on the invoice.

Hold Back Item – Select the Invoice Item that will be used when an invoice is created for the hold back Job Type (same G/L Account as the next field). The Invoice Item selected should be setup with the Item Type of OC (Other Charge), flagged as non-taxable, and linked to your Hold Back asset account.

Hold Back Acct – Select the G/L account number that will be used when invoicing the customer for job hold backs at the end of the job, or a intermediate points during the Job. This G/L account is an asset type account (OCA).

EST LU Cost (Estimated Labor Unit Cost) - This optional field is used to establish a standard labor rate to be used to calculate the estimated labor costs for a job. On the Job’s Job Costing form, a button is available to automatically calculate the estimated labor dollars for the job. If a value is entered in this field, the application will add all labor units from Parts and all labor units entered on Install charge lines then multiply the total times the value entered in the Est LU Cost field.

Zero Part Price - This checkbox option controls whether the sales price for each part on the Materials setup form of a Job will default into the unit price field for all parts on the Job Materials list. If this checkbox is selected, all Job part sales prices will be set to zero. If this checkbox is not selected the application will default to the part setup sales price. This option is typically select if you are invoicing your customer under a lump-sum contract amount.

Material Item - This field is used for Jobs imported from a WeEstimate quote. If Parts will be individually invoiced for the Job, this will be the Item Code that will be used for posting the Income side of the Invoice transaction.

FRM 24702

Previous Page Page 4 of 13 Next Page