Job Management Job Invoicing Hold Back Invoicing

Hold Back Invoicing (continued)

Invoicing for Hold Back Amounts

There a two methods for creating invoices for the amounts held back on Job invoices.

·You may create a Hold Back Invoice at any time for all or a partial amount of the total amounts withheld from Job Invoices while the Job is open.

·Let the application create the Hold Back Invoice during the Job Closing process; all amounts withheld from Job Invoices will be invoiced on one invoice.

Where Hold Backs are a part of the contract with your customer, many times the contract dictates that you are not able to invoice for Hold Back amounts until the completion of the project or a number of days after the completion of the project. You have the option of leaving the Job open and waiting to invoice for the Hold Back amounts at some time in the future or you may create the Hold Back Invoice and either change the invoice terms to a longer time than normal or you may change the aging date of the invoice to a date into the future.

Invoicing for Holdback amounts as soon as possible and pushing out the aging date or changing the terms, allows you to close the Job on a timely basis and not affect your current receivables numbers. Of course, the method your company uses is completely based upon your company's policies and procedures.

Follow the links below for instructions on creating Hold Back Invoices for both methods mentioned above.

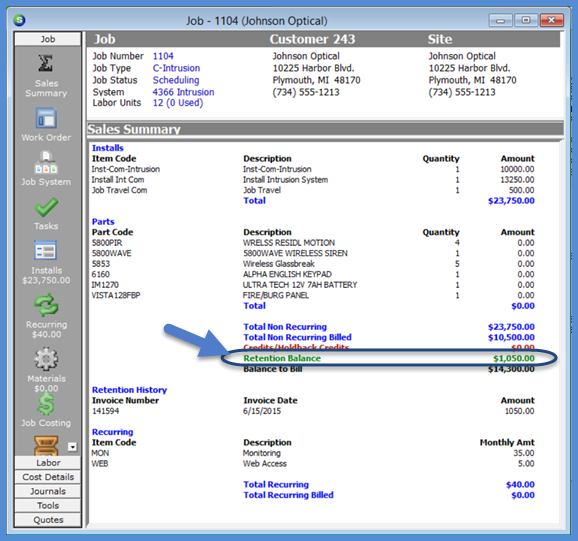

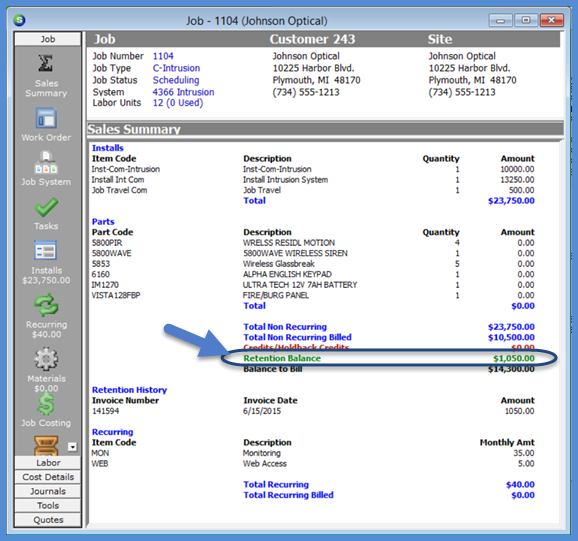

As Job Invoices are created and Hold Back amounts are deducted, these amounts are viewable from the Sales Summary of the Job; see the example below.

11310

Previous Page Page 4 of 4