Job Management Job Management Setup Job Type Setup

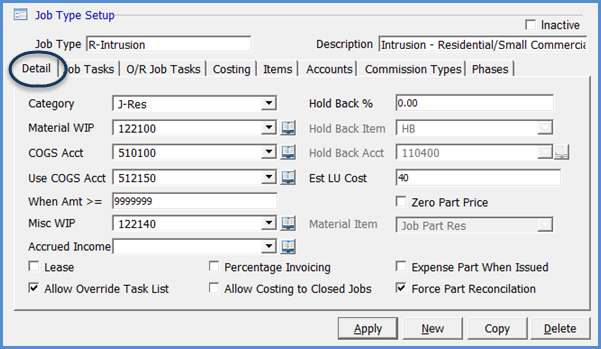

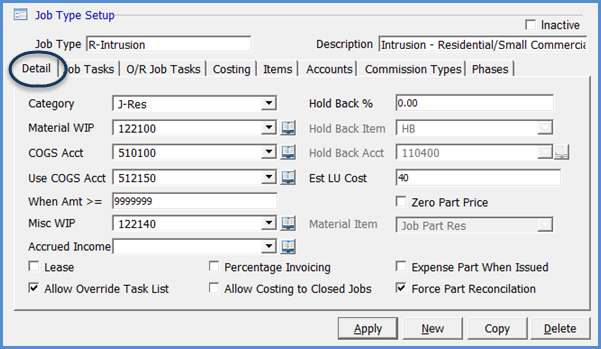

The Job Type Detail form contains settings and G/L posting accounts that are used by the application when posting transactions to a Job. Below and on the next page are definitions of each field contained on the Detail form.

Category – Select the category from the drop-down list that will be used as a default when posting income and expense transactions for this Job Type.

Material WIP – Select the G/L account number from the drop-down list that will be used for posting Material WIP transactions. This account is used when inventory parts are issued to the job or returned to a warehouse from a job.

COGS Acct - Select the G/L account number from the drop-down list that will be used for posting material cost of goods sold transactions.

Use COGS Acct – This field is used in conjunction with the When Amt >= field below. If you want to use a different material cost of goods sold account for inventory parts that have a cost of at least a certain amount, you may select that account number in this field.

When Amt >= - This field is used in conjunction with the Use COGS Acct field (above). If a part is issued to a job with a cost that is greater than or equal to the value entered in this field, then the G/L account number entered in the Use COGS Acct field will be used for the transaction.

Misc WIP – Select the G/L account number from the drop-down list that will be used for posting miscellaneous job expenses into work in process.

Accrued Income - If a G/L account number is entered in this field, all invoices generated for the job will post to this accrual account. When the job closes, the income will be transferred to the income accounts assigned to the invoice items on the job invoices.

Lease – This is field is for informational and reporting purposes only. If the Job Type is for a lease you may select this box.

10107-1

Previous Page Page 2 of 11 Next Page