SedonaSetup Accounts Receivable Setup Tables/Options

Tax Tables Field Definitions (continued)

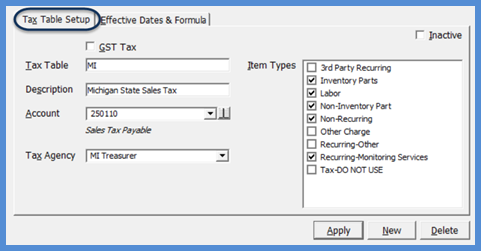

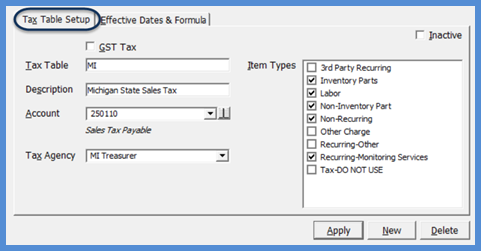

Tax Table Setup [tab]

Tax Table - The code you will use for the tax table. You may enter up to 25 characters in this field. If your company does business in multiple states, you may want your tax table codes to begin with the two character abbreviation of the state.

Description - The description for the tax table. You may enter up to 50 characters to describe the tax table.

Account - Select a G/L account from the drop-down list from the Chart of Accounts setup table which is the liability account to which you will to post sales tax transactions for this tax table.

Tax Agency – From the drop-down list, select the Tax Agency to whom you will remit sales tax collected for this tax table.

Item Types – Check the box to the left of each Item Type where the type of service provided is possibly taxable in this tax table jurisdiction.

FRM 24076

Previous Page Page 3 of 4 Next Page