Job Management Job Management Setup

The Job Management Setup Processing form contains defaults that are used by the application when creating Install Company records and posting costs to a Job. These settings and rules will be used when posting costs to Jobs unless different settings are setup in the Install Company or Job Type setup tables.

If different settings & G/L accounts are needed at the Job Type level, the Job Type settings will override the Install Company & Setup Processing settings & G/L accounts.

Material WIP

·If using WIP for parts, the G/L account on the JM Setup Processing form will be used when parts are issued to a Job.

·If the Material WIP G/L account is different on the Install Company, the application will use the G/L account from the Install Company of the Job.

·If a different G/L account is used on the Job Type setup, the application will use the settings from the Job Type for the Job.

Job Material COGS

·This G/L account on the JM Setup Processing form will be used for parts used on a Job.

·If a different Material COGS account exists on the Job Type, the application will use the Job Type Material COGS account.

Labor

·All timesheets posted to a Job will use the G/L accounts and expense method on the JM Setup Processing form.

·If different G/L accounts exist on the Install Company, the application will use the G/L account from the Install Company of the Job. or the Job Type. The Job Type setup will always be used if any Labor setup values exist for the Job Type.

·If different G/L accounts are setup on the Job Type setup, the application will use the settings from the Job Type for the Job.

Commissions

·Commission entered on a Job will use the G/L accounts and expense method setup on the JM Setup Processing form.

· If different G/L accounts exist on the Job Type, the application will use the setup from the Job Type associated with the Job.

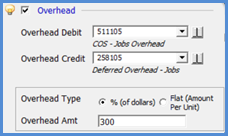

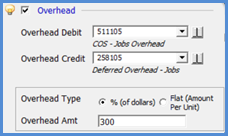

Your company the option of posting an Overhead amount to Jobs each time Labor is posted to a Job. Applying overhead should only be done if the hourly rates setup on your Installer records are the actual wages paid to the employees. Using the Overhead option is optional; at the end of the accounting month, you would need to do a journal entry to reverse out any overhead that was posted to the overhead accounts since actual overhead expenses are posted through accounts payable as expenses occur.

If the Overhead option is selected in Job Management Setup Processing, an Install Company or a Job Type setup, you will need to select the method the software will use to calculate and post the overhead amount to the Jobs.

·% of Dollars - when selecting this method, you are required to enter a value into the Overhead Amt field, which is the overhead rate. When a Job Timesheet is posted, the software will use this percentage and apply for each labor dollar posted in the timesheet. For example, if the Installers hourly rate is $20.00/hour and we set our overhead rate to 300%, when posting one hour of labor on a timesheet, the overhead posting amount would be $60.00 ($20.00 x 1) x 300% or (hourly rate x hours worked) x overhead rate.

·Flat Amount per Labor Unit - when selecting this method, you are required to enter a value in the Overhead Amt field, which is the overhead rate. When a Job Timesheet is posted, the software will use this amount and apply for each labor unit (hour) posted on the timesheet. For example, the Overhead Amt is set to $15.00 and we post two hours of labor on a timesheet, the overhead posting amount would be $30.00

·All Overhead posted to a Job will use the G/L accounts and expense method on the JM Setup Processing form.

·If different G/L accounts exist on the Install Company, the application will use the G/L account from the Install Company of the Job. or the Job Type. The Job Type setup will always be used if any Overhead setup values exist for the Job Type.

·If different G/L accounts are setup on the Job Type setup, the application will use the settings from the Job Type for the Job.

10102

Page 1 of 2 Next Page