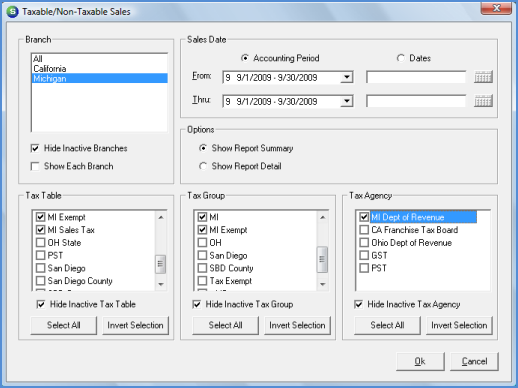

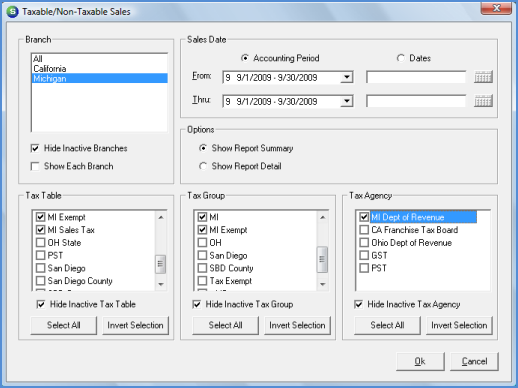

Report Manager General Ledger Reports

The Taxable/Non-Taxable Sales Report generates a listing of sales tax from invoices and credit memos within the period of time selected for the report. This report may be generated in two styles; Summary and Detail. When the Summary style option is selected, the report is summarized by sales tax by Item Type. When the Detail style option is selected, the report will print each invoice summarized by Item Type.

This report has a branch option; if multiple branches are selected, a new report will print for each unique branch.

Once the desired options have been selected, press the OK button to display the report in print preview mode.

Report Selections

Branch - The default is to display data for All Branches. If the data for only certain Branches is desired, the User may highlight the first Branch, then depress the CTRL key and highlight additional Branches within the list.

· Hide Inactive Branches - If data is not to be listed for inactive Branches, select this option.

· Show Each Branch - If this option is selected, a new page will begin with each unique Branch. Totals are printed after all data is printed for a Branch. The last page of the report will print Totals by Branch and a Grand Total for all Branches.

Sales Date - This option will default to the Current Accounting period. If a different Accounting Period or specific Date range is desired, select either the Accounting Period option or Dates option. Once an option is selected, the User must select an Accounting Period range or Date range.

Options

· Show Report Summary - Select this option to print the G/L Account Number. If this option is not selected, the GL Account Description will be printed.

· Show Report Detail - Selecting this option will print the date and time the report was generated in the upper left corner of the report.

Tax Table - The default is to print all paid invoices on the report within the options selected above. By selecting one or multiple Tax Tables, only the paid invoices associated with the selected Tax Tables will display on the report.

Tax Group - The default is to print all paid invoices on the report within the options selected above. By selecting one or multiple Tax Groups, only the paid invoices associated with the selected Tax Groups will display on the report.

Tax Agency - The default is to print all paid invoices on the report within the options selected above. By selecting one or multiple Tax Agencies, only the paid invoices associated with the selected Tax Agencies will display on the report.

Report72