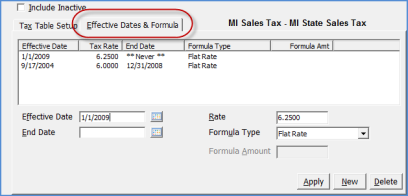

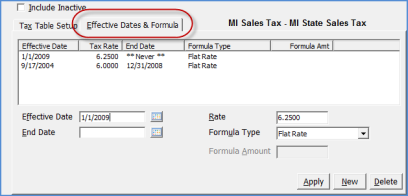

SedonaSetup Application Accounts Receivable Setup Tables/Options

Formula Type – Defines which method the program will use to calculate sales tax on an invoice.

Flat Rate – sales tax will calculate on the invoice item and/or inventory parts based on the rate entered in the Rate field of the Effective Dates and Formulas form.

Max Taxable Sale - sales tax will calculate on the invoice item and/or inventory parts up to the dollar amount entered in the Formula Field. For example if the formula amount is set to $5,000.00 and the invoice item is for $10,000.00, only the first $5,000.00 will be taxed.

Min Taxable Sale - sales tax will calculate on the invoice item and/or inventory parts beginning at the dollar amount entered in the formula field. The Invoice item must be for at least the minimum amount entered in the Formula Amount field; all amounts at and above the setup amount will be taxed.

Maximum Tax - sales tax will calculate on the invoice item and/or inventory parts up to a particular amount of sales tax. For example if the formula amount is set to $75.00 and the calculated amount of tax is 76.00, only $75.00 of sales tax will be recorded against the invoice item.

Pctg of Sale – (Percentage of Sale) sales tax will calculate on the invoice item and/or inventory parts as a percentage of the sale amount. For example, if the tax rate for the Tax Table is set to 5% with the formula of 10, and the invoice amount is $50.00, sales tax would be calculated on 10% of the invoice amount at the rate in the tax table which is applicable to the invoice item type. The calculation would be ($50.00 x 10%) x 5% for a total sales tax amount of $0.25.

24078