General Ledger Overview (continued)

Deferred Income

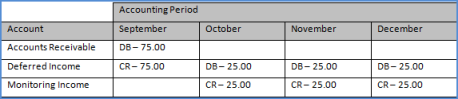

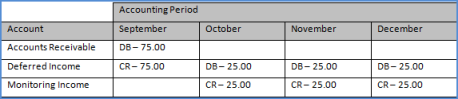

Your Deferred Income is automatically tracked when you generate your recurring invoices. Income that is generated for a future accounting period when you create your recurring revenue invoices is tracked in a special account identified in the system as the “Deferred Revenue” account. For each accounting period thereafter the appropriate amount of income will be generated, and the Deferred Income will be properly lowered.

Deferred Income Example: September 20th, a quarterly monitoring invoice is generated for $75.00, for the service period of October – December.

ss5001