Accounts Payable Bills Entering Bills with a Receipt

Entering Bills and Matching to a Receipt

Once a Purchase Order is received for Inventory Parts or Expense Items a Receipt record is created and posted to the General Ledger. If receiving purchase orders, it is important to always match a bill to a receipt record. If a bill is entered and not matched to the corresponding receipt record, the Inventory Receipts account on the balance sheet will be overstated.

Parts Received into a Warehouse

For parts receipts, a debit is posted to the Inventory account associated with the warehouse into which the parts were received and a credit is posted to the Inventory Receipts account (SedonaSetup G/L Account Defaults for AP).

Parts Received as a Direct Expense

If the parts were direct expensed on the Purchase Order, by default a debit is posted to the COGS account in SedonaSetup Inventory Setup, however the User may override the COGS account on the part receipt record; the credit is posted to the Inventory Receipts account.

Expense Items Received

For Expense Item receipts, a debit is posted to the G/L account(s) specified on the Purchase Order and a credit is posted to the Inventory Receipts account.

Follow the instructions below to enter a bill by matching to a receipt record.

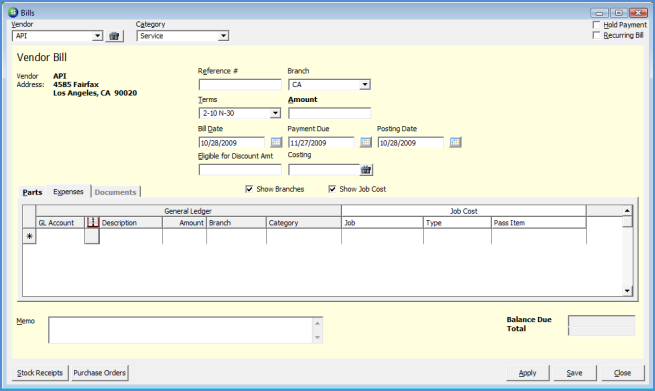

1. The User may enter a new Bill either from Accounts Payable/Bills or from the Vendor Explorer and right-clicking on the Bills tree option and selecting New Bill.

![]() If entering

several Bills for the same Vendor, it is easier to work from the

Vendor Explorer record.

If entering

several Bills for the same Vendor, it is easier to work from the

Vendor Explorer record.

6004.1