Job Management Job Invoicing Hold Back Invoicing Overview

Hold Back Invoicing Overview

Hold Back Job Types are typically used on government or general contractor type jobs where the customer requires your company to hold back a certain percentage of each invoice and then invoice for all amounts held back some time after the customer has accepted the work as being completed to their satisfaction; normally this is 30 days after the completion of the job. SedonaOffice provides the functionality to accomplish this by creating a special Job Type for this purpose.

When a Job is invoiced using the Hold Back method, the application will create an invoice for the total amount of the charges and also create a credit memo for the holdback percentage amount of the invoice. During the Job closing process a new invoice is created for the amounts that were held back from previous Job Invoices.

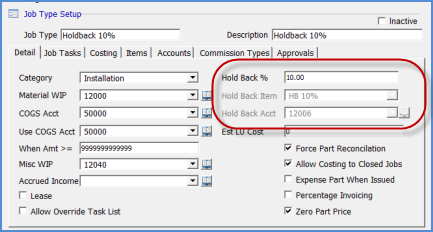

Hold Back invoicing may only be accomplished if the Job Type select for the Job is set up for Hold Back Invoicing. There are three fields on the Job Type setup form which designate the Job Type to be used for Hold Back invoicing; Hold Back %, Hold Back Item and Hold Back Acct. Please refer to the next page for explanations of the G/L flow for Hold Back Invoicing transactions.

Hold Back % - The percentage of the total charges being invoiced that will be deducted from each invoice created for a Job.

Hold Back Item - Invoice Item that will be used when generating the Hold Back invoice during the Job Closing process. The G/L account used on this item code setup must be the same as the Hold Back Account (next field below).

![]() When setting up this Invoice Item, make certain

to select the Item Type of NR and mark as non-taxable.

When setting up this Invoice Item, make certain

to select the Item Type of NR and mark as non-taxable.

Hold Back Acct - The G/L account (asset) where the hold back amounts deducted from the job invoiced will be recorded and remain until the end of the job.

ss11050

Follow the topic link below for step by step instructions on creating Hold Back Invoices and Creating the Invoice for amounts held back during the Job Closing process.