Accounts Receivable EFT Processing Bank Setup

A User may enter and store any number of ACH Banks to a customer record. Only one of the ACH Banks entered may be flagged to use for automatic payment processing for cycle invoices. Once the bank account number is entered and saved, the number is encrypted. If a User returns to edit information on the ACH Bank setup, only the last four digits of the bank account number will be visible.

To set up customer ACH Bank information, follow the steps listed below.

1. Open the Customer Explorer record for which credit card information will be set up.

2. From the Customer Tree, highlight Payment Options; right-click and select the Edit Electronic Funds Transfer option.

3. The EFT Setup form will be displayed. ACH Bank information is set up on the left side of this form. In the Banks on File field, press the drop-down arrow and select the option New Bank.

4. Bank - Select the customer bank from the drop-down list. If the customer’s bank routing number is not on the list it may be created and added to the customer bank list. To add a new customer bank, press the "..." icon located to the right of the Bank field.

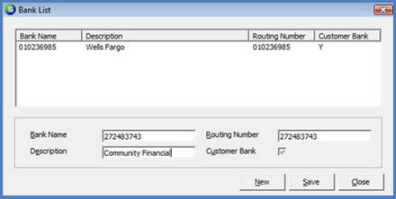

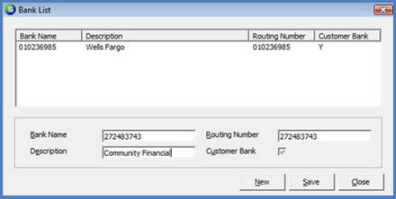

The Bank List form will be displayed. Press the New button located at the lower right of this form. In the Bank Name field type in the bank routing number. In the Description field type in the name of the financial institution. In the Routing Number field type in the bank routing number (you may copy and paste from the Bank Name field). Press the Save button located at the lower right of this form to save the new bank information.

SedonaOffice recommends typing in the routing number in the Bank Name field; when searching for a particular routing number, the primary search is on the Bank Name field – this makes it faster to find the correct routing number.

The SedonaOffice application validates whether the routing number entered by the User is correct. If the routing number entered is invalid, the User will be presented with a message indicating the entry is invalid. If this occurs, the User may re-type in the routing number and re-save the information.

4023