General Ledger Deferred Income Deferred Income Recognition Process

Deferred Income Recognition Process

The Deferred Income Recognition Process may take some time to run if your company generates many thousands of Cycle Invoices each month. This process may be run at any time of day, however, once this process is launched, Users should not be crediting off Cycle Invoices or posting any new Cycle Invoices while the process is running.

To run the Deferred Income Recognition Process, follow the instructions below.

![]() Prior to beginning this

process, close all software applications other than SedonaOffice on

the workstation running the process. This program requires a

great deal of memory and you do not want other applications to

interfere with the processing of data while it is posting to the

general ledger.

Prior to beginning this

process, close all software applications other than SedonaOffice on

the workstation running the process. This program requires a

great deal of memory and you do not want other applications to

interfere with the processing of data while it is posting to the

general ledger.

1. Navigate to the General Ledger module from the Main Application Menu and select the Deferred Income option.

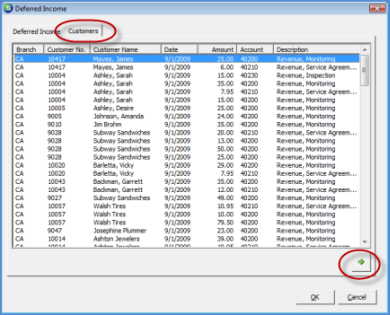

2. The Deferred Income form will be displayed. This form is divided into two tabs; the Deferred Income tab contains date fields used for selecting the period that will be earned and the date the Deferred Income transactions will post to the General Ledger. The Customers tab is used to display a list of customer invoices that will be earned for the period specified on the Deferred Income tab.

On the Deferred Income tab, in the Recognize the Unposted Deferred Income as of the following Date field, enter the last day of the month for which you are recognizing the Deferred Income. In the Posting Date field, set this to the same date as entered in the previous field. The Amounts displayed below will show how much income will be recognized for the period for both Invoices and Credit Memos.

3. Once the date fields have been selected, press the OK button located at the lower right of the form.

.png)

5009

ss5103