General Ledger Deferred Income

Deferred Income Overview

Your Deferred Income is automatically tracked when recurring invoices are posted. Income that is generated for a future accounting period is tracked in a special account identified in the system as the “Deferred Income” account. For each accounting period thereafter the appropriate amount of income will be generated, and the Deferred Income will be properly lowered. When a batch of cycle invoices is posted, each line item on the invoice contains a service period. The application uses the service period being invoiced to determine how to break down the future income into the appropriate month is should be earned. All cycle invoices post into the Deferred Income account regardless of the billing cycle.

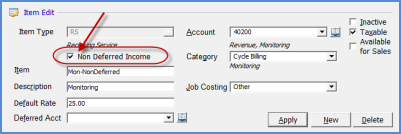

The only Cycle Invoice Items that will not post to the Deferred Income account are invoice items that are flagged not to defer in SedonaSetup.

ss5100