Service Service Ticket Overview Billing Form

Billing Form Definitions (page 4)

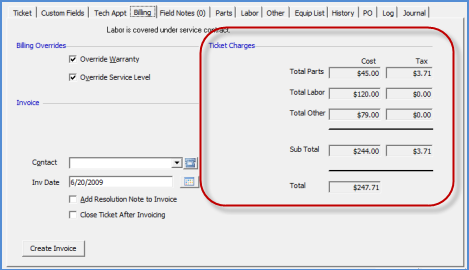

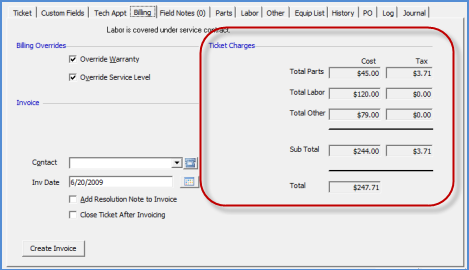

Ticket Charges

The Ticket Charges section summarizes the amounts calculated for Parts, Labor, and Other Charges which are billable. If sales tax is applicable, these amounts will be displayed in the corresponding charge line. Sales Tax is determined by the rules assigned to the Tax Group of the Site linked to the Service Ticket. Once an invoice is created, the User has the option of changing the Tax Group for the Service Invoice if necessary. If the Tax Group is changed on the invoice, sales tax will recalculate according to the rules of the selected Tax Group. User permissions are required to edit a saved invoice.

Total Parts - The amount displayed is the total billable amount for any parts listed on the Parts form of the Service Ticket. If Parts are taxable, an amount will be displayed in the Tax column.

Total Labor - The amount displayed is the total billable labor calculated on the Labor form of the Service Ticket. The Labor form totals the Regular Labor, Overtime Labor and Holiday Labor. If a trip charge is included and is using a Labor Type Invoice Item Code for the trip charge, this amount will be included in the Labor amount. If labor type charges are taxable, an amount will be displayed in the Tax column.

Total Other - The amount displayed is the total billable Other charges calculated on the Other form of the Service Ticket. Other charges are manually entered or may be defaulted from a Service Level. If any of the Other charges are taxable, an amount will be displayed in the Tax column.

Sub Total - The amount displayed is the total of all Parts, Labor and Other charges.

Total - The amount displayed is the total of all Parts, Labor, Other charges and Tax.