General Ledger Deferred Income

Deferred Income Overview (continued)

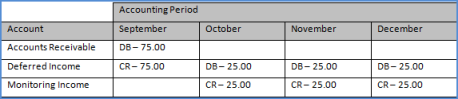

Deferred Income Example:

On September 20th, a quarterly monitoring invoice is generated for $75.00 for the service period of October – December. The invoice will post to Accounts Receivable as of the Invoice Date and the deferred income will be divided between the accounting months for the service period invoiced. Each month a portion of the Invoice will be earned when the Deferred Income Process is run.

ss5001

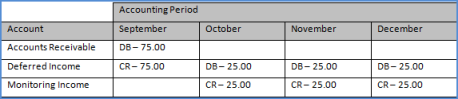

If a Cycle Invoice is credited off, the application will post a credit amount to the Deferred Income account for each month in service period for the invoice. Basically a Cycle Invoice Credit is spread out over the service period of the original invoice. The next effect will be zero to the G/L since the original invoice and the credit memo will be recognized in the same month thus cancelling each other out. If the invoice being credited off contains a service period where the Deferred Income has already been recognized and the Accounting Period has been closed, the credit will be earned in the current open accounting period.

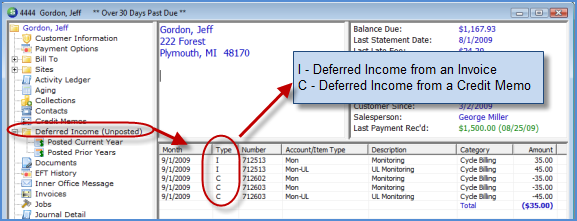

Each Customer Explorer record displays a list of Deferred Income yet to be earned as well and income earned in prior periods.

ss5105

ss5105-1

For Instructions on how to run the Deferred Income Process, follow the link below:

Deferred Income Recognition Process