Closing a Fiscal Year

Closing A Fiscal Year: November, 2017 Download PDF

Closing A Fiscal Year: November, 2017 Download PDF

SedonaOffice enables two fiscal years to be open at one time. If your company uses January-December as its fiscal year, and your General Ledger Accounting Periods display the year 2016, fiscal 2016 will need to be closed before the year 2018 can be opened. To close a fiscal year:

1) Select the Close Fiscal Year option from the General Ledger tree.

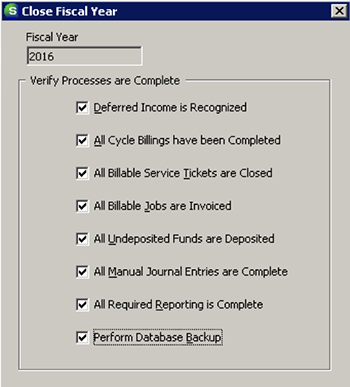

2) A checklist will be presented asking for confirmation that the following has been completed. Place a checkmark next to each item that has been completed. Press Save.

3) The user will receive a confirmation message asking “Are you sure that you are ready to close out Fiscal Year 2015?” When the “Yes” button is pressed as confirmation, the application will clear out the income, expense, and cost of goods sold accounts and then update the retained earnings account for that fiscal year.

Once a fiscal year has been closed, it cannot be reopened.

**Scroll Down for more Year End Closing Tips!

Inventory Question? We got you covered.

Is it time for Inventory? If so, check out our Physical Inventory Reference Guide with step-by-step directions for doing this correctly! Directions can be found here. Everyone that will be involved in planning, entering counts, reviewing variances, and posting of the inventory should read this document.

Planning a Rate Increase? No problem.

Planning a rate increase? Look for the step-by-step directions for selecting the customers that should receive the increase and eliminating those who should not. Directions may be found here.